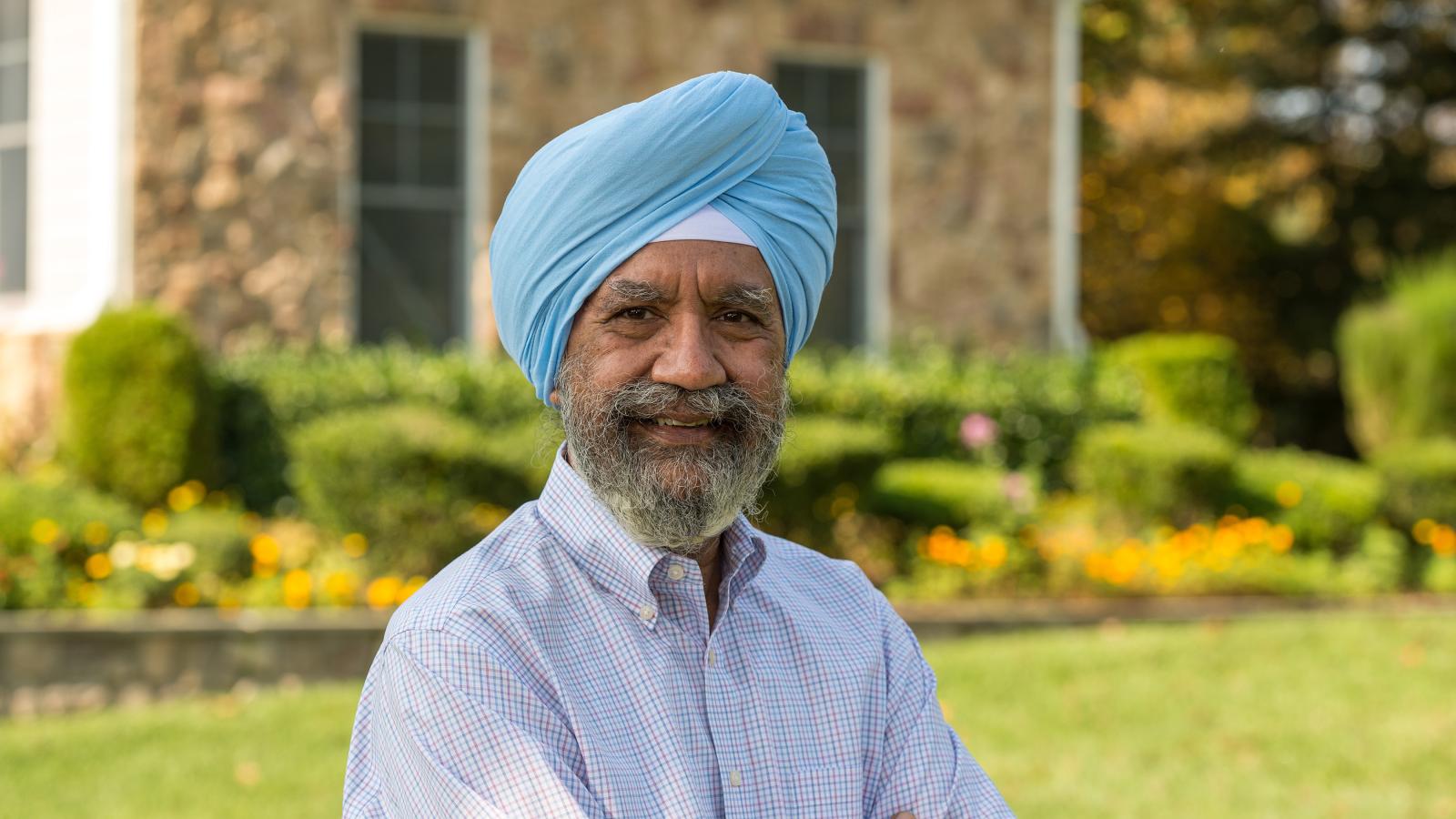

Retired Orthopaedic Surgeon Invests in MCV Campus with IRA Rollover

Gurpal Bhuller, M.D., has treated patients for more than 30 years at both VCU Health and his own practice in Colonial Heights.

Growing up in Malaysia, it was his dream to become an orthopaedic surgeon. He studied medicine in India and went back to his home country to begin his medical practice. Dr. Bhuller then went on to New Zealand to continue with postgraduate training and eventually came to the U.S. in 1980.

“It’s the immediacy of orthopaedics that drew me,” he said. “You can help someone immediately when they’re in trouble with a fracture or an accident and see the tangible results of making them better instantaneously. Plus, you can always see your results on an x-ray.”

Over the years, Dr. Bhuller has treated patients with traumatic injuries from falls, car accidents and sports trauma. But, the majority of his practice involved patients who were having long-term back pain, hand pain or leg pain from chronic overuse injuries and arthritis.

“It was very rewarding. Medicine is a very rewarding field,” he said.

Dr. Bhuller operated his own practice in Colonial Heights, Virginia, from 1982 to 2015. He frequently partnered with surgeons in the VCU School of Medicine’s Department of Orthopaedic Surgery to consult on more complicated cases. Dr. Bhuller served as a faculty member in the Department of Orthopaedic Surgery from 2008-2011 and his practice in Colonial Heights merged with VCU Health last year.

“We’re so grateful to MCV for supporting us in the early days of our practice when we had difficulties or complicated cases. There was never any hesitation to step in, whether it was providing advice or accepting the transfer of a patient,” Dr. Bhuller said.

In 2015, he and is wife Neena Singh, M.D., an alumna of the VCU School of Medicine’s Department of Psychiatry, established the Bhuller Orthopaedic Research Fund to support the Department of Orthopaedic Surgery. “Medicine has been advancing in all fields of orthopaedics and there are many layers of research. Young people need funding for new ideas. This fund supports those people with groundbreaking ideas. I’ve already seen the laboratory and some of the exciting advances they are making in nerve repair,” Dr. Bhuller said.

In 2020, Dr. Bhuller decided to make another gift to this research fund in the form of an IRA Charitable Rollover. “I was getting to the stage where I needed to make my required minimum distributions. I decided this would be a better way to do it,” he said.

It was a simple process as Dr. Bhuller explained, “I told my IRA administrator to write a check to the MCV Foundation to go to this research fund. There’s a huge tax benefit. When you make a gift from your IRA, it’s not considered taxable income so you don’t pay any tax on the gains that may have accrued.”

Though retired, Dr. Bhuller remains active with his wife and two daughters in Northern Virginia, and through his charity work in India. “There are a lot of eye problems there,” he said. “There’s so much need and for just $22 you can give a person cataract surgery.”

Dr. Bhuller remains active with his wife and two daughters in Northern Virginia. He is involved with Operation Walk in the U.S., a home for single mothers in Malaysia and organizing Eye Camps in India. “Did you know that through the Eye Camps you can get a cataract surgery done in India for only $22!” he said.

You can create a living legacy like Dr. Bhuller and help shape the future of the MCV Campus. The IRA Charitable Rollover allows you to support the school, program or department you choose, while receiving favorable tax benefits.

The CARES Act suspended RMD requirements for 2020, but you can still make an IRA Charitable Rollover if:

• You are 70 1/2 or older.

• Your gift is from a qualified retirement plan such as 401(k), 403(b) or IRA.

• You are transferring no more than $100,000 per taxpayer per year from your IRA to

qualified charities.

• Your gift is sent directly to the MCV Foundation from your IRA account administrator.

IRA Charitable Rollovers are not included in your taxable income, and no charitable deduction is allowed. To learn more about this tax-friendly way to support the MCV Campus, please contact Ann Deppman.