A 'Win-Win': How IRA Charitable Rollover Gifts Enable Steady Support

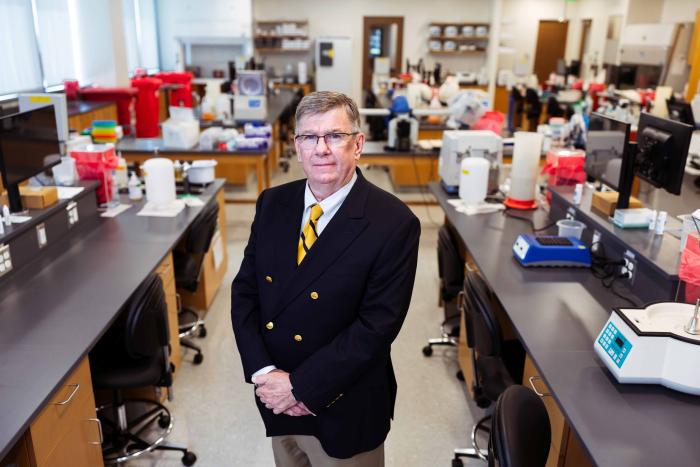

Michele and Don Romano have a simple goal when it comes to supporting the MCV Campus.

“It’s our favorite charity, and our objective is to donate as much as possible,” Don explained. Both Don and Michele are MCV Campus alumni, and Michele serves on the board of the MCV Foundation.

Through the foundation, they learned about IRA Charitable Rollovers as a unique and easy way to support the academic health center. The Romanos have also included generous support through planned bequests to fund faculty chairs and scholarships at three of VCU’s health science schools, but their use of IRA Charitable Rollovers allows them to give back each year to support the academic health center.

“I think it’s an absolutely fascinating way to give back,” Michele said. “It allows you to give more money to the charity you want — hopefully the MCV Foundation — and save on taxes. It’s just such a win-win.”

This way of giving is simple and easy to understand. Once individuals turn 70 1/2, they are required by federal tax law to make annual withdrawals from their individual retirement accounts (IRAs). Those withdrawals, or required minimum distributions, would normally be taxed. Through an IRA Charitable Rollover, people can request that a gift be made from their IRA, sending either the required minimum distribution or a portion of it, directly to the charity they wish to support. Those donated funds are not taxed.

“All of the things I’ve been able to do in my professional life, MCV really opened the door for them,” Don said. “We think that it’s worthwhile and good for people to give back to the university. It’s like paying it forward — to be able to help the next generation.”

For the Romanos, the MCV Campus has been an integral part of their story and success through life’s many twists and turns.

The two married shortly after graduating from college. A month later, Don was drafted into military service during the Vietnam War. He shipped out to Fairbanks, Alaska, where he learned he could eschew living in the barracks and move up his new wife, a nurse, to live with him off base.

“When I landed, it was mid-January and the temperature was a legit 60 degrees below zero,” Michele remembers.

Their adventures didn’t end with the extreme cold. Shortly after the Romanos arrived, oil was discovered 400 miles north of Fairbanks in Prudhoe Bay. The city began bustling with trucks and heavy equipment. Almost in tandem, the need for advanced medical capabilities became evident.

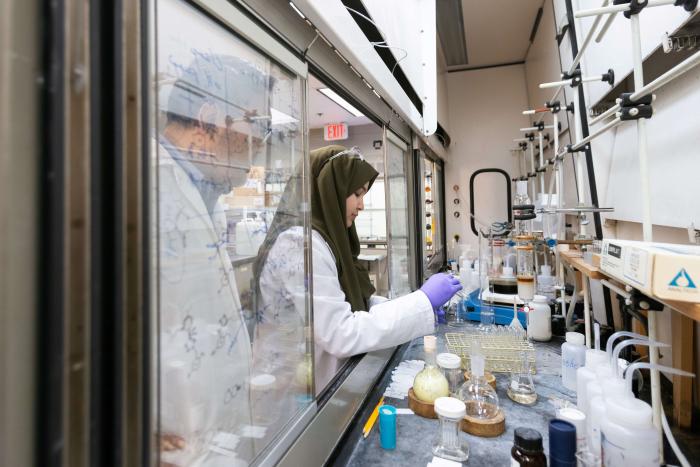

“We were the only full-service hospital in the interior of Alaska,” Michele said. “This was a small hospital in bush country. We were the closest hospital – they had nowhere else to go. We had very few doctors, and suddenly we needed to build an intensive care unit.”

Michele’s prior experience in critical care equipped her to train and lead the nursing team at Alaska’s first community hospital. She shared a textbook she’d used with the doctor in charge and asked for standing orders she could use to train other nurses. After paging through the book, the doctor signed the textbook and handed it back to her with the directive, “if it’s in there, you can do it!”

Those 18 months in Alaska were a formative time for both Romanos. Don soon received discharge from the service, and Michele left Alaska battle-tested and eager to challenge herself as a healthcare professional. They moved to New York, where he earned an MBA at the University of Buffalo. Soon after, Don began contemplating a career move into healthcare administration.

At the time, healthcare administration was a relatively new field of study. There were fewer than 10 programs in the country, and MCV’s stood out to Don because of its strong reputation and the internship component. He also admits the weather situation seemed phenomenally better compared to Alaska and Buffalo, N.Y.

In 1973, Don graduated with his master’s in health administration from what is now the VCU College of Health Professions and began a successful and diverse career in healthcare administration.

A few years later, Michele found herself at a career crossroads. She craved new challenges and knew she wanted to continue providing frontline patient care. Her next step would eventually lead her back to Richmond, where she had worked as chief nurse of the intensive care unit at Retreat Hospital when Don was studying at MCV. She returned to Richmond and entered the School of Medicine at age 32.

After graduating in 1984, she completed her residency with VCU in family medicine and practiced independently in northern Virginia before retiring in 2015.

Both Don and Michele say their time on the MCV Campus helped define their careers and life together through many different adventures.

“We couldn’t be more grateful and privileged to be a part of this place,” Michele said. “We both think that we have the life we have today and the opportunities and the privilege to give back because of MCV.”

Like the Romanos, You Too Can Use Your IRA to Create a Living Legacy

- Donors must be 70 1/2 or older.

- Gifts can count toward a required minimum distribution (RMD).

- The gift is not included in taxable income, and no charitable deduction is allowed.

- Gifts to all charities combined cannot exceed $100,000 per taxpayer, per year.

- The gifts must be made directly from the IRA to the MCV Foundation.

If you’d like to learn more about how you can support great care, research, and education on the MCV Campus through an IRA Charitable Rollover gift, please visit our planned giving page.