Donating Stocks Can Help Save Lives, and It’s Easy to Do

As the stock market continues to reach all-time highs, now is a particularly opportune time to leverage your investments’ success to save lives through donating appreciated stock.

Giving appreciated stock is tax-efficient and an easy process you can use to help fight disease in our community or influence medical research and education that reaches around the globe from the MCV Campus.

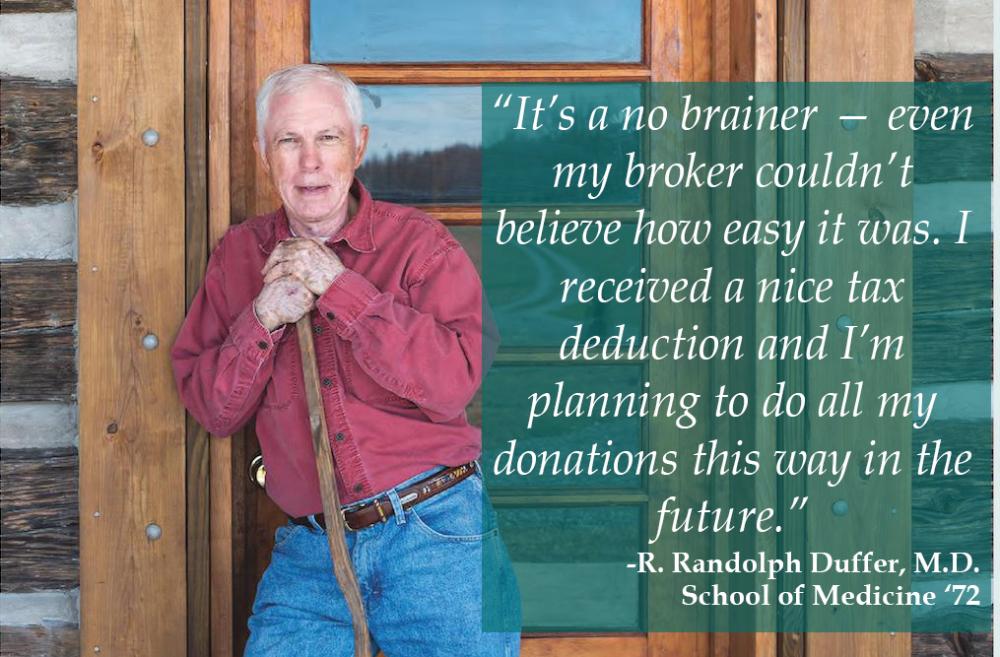

To learn more about the process of donating appreciated stock from a donor’s perspective, we spoke recently with 1972 VCU School of Medicine alumnus R. Randolph Duffer, M.D., who is a family physician in rural Virginia.

“I’m a solo country doctor and the process was unbelievably quick and simple,” he said. “I had some stock that was up and decided this would be a good time to make a tax-deductible donation and avoid a capital gains tax. I went to see my stock broker during lunch, signed permission to transfer the stock, and received a letter from the MCV Foundation detailing the exact amount of my gift a few days later.”

To encourage medical students to pursue careers in family medicine like he chose to do more than 40 years ago, Dr. Duffer decided to support the School of Medicine’s fmSTAT program. fmSTAT uses mentoring, scholarships and other tools to develop, nurture and support medical students who are committed to pursuing careers in family medicine.

Encouraging students to go into family medicine is important to Dr. Duffer because there is a shortage and pressing need for family physicians in our country, especially in rural communities. Family physicians create relationships with their patients that help prevent serious medical issues, inform healthy lifestyle choices, identify risk factors among families, cut down on healthcare costs by keeping people out of emergency departments and assist patients in navigating complex healthcare systems.

Beyond the impact on patient care, research and education for the MCV Campus, the benefits of giving stock include the following.

- You avoid paying capital gains tax on the sale of appreciated stock.

- You receive a federal income tax deduction for the full fair market value of your stock gift.

And we’re here to make the process as easy as possible.

“There was no check or accounting issues to deal with,” Dr. Duffer told us. “It’s a no brainer — even my broker couldn’t believe how easy it was. I received a nice tax deduction and I’m planning to do all my donations this way in the future.”

To learn more about how you can make a gift of stock to support the MCV Campus, please visit our securities page or contact Brian Thomas, MCV Foundation vice president and chief development officer, at 804-828-0067 or bthomas@mcvfoundation.org.

If you’re already speaking with a representative from one of our MCV Campus partners about making a gift, please let him/her know you read this article and would like more information.